In searching for Country or Homestead property it is important to know if the property is in a Flood Plain.

The U.S. Federal Emergency Management Agency’s (FEMA) definition of a Flood Plain is: any land area susceptible to being inundated by flood waters from any source.

We will look at:

- Why it is important to know if the property is in a flood plain

- How to know if the property is in a flood plain

- Insuring property in a flood plain

- How wildfires can contribute to flooding

Why It Is Important To Know If The Property Is In A Flood Plain

If you purchase a house that is in a flood plain you will need to buy flood Insurance.

This insurance protects against the loss of the home in a flood.

Most banks, mortgage companies and credit unions that finance the purchase of homes require this insurance if the home is in a flood plain.

If you are wanting a Country Homestead, knowing whether or not the property is in a flood plain is even more important than if you are merely purchasing a house.

A Homestead has other very important buildings and areas that need pre-purchase consideration.

Many homesteads will have a barn to house livestock and protect equipment such as a tractor.

They can have outbuildings such as a chicken coop.

There is usually a garden area and there may be an orchard, berry patch and even a greenhouse.

There can be ground sources of water that are important to the care and functioning of the homestead.

These sources could be ponds, creeks or springs.

If a homestead is in a flood plain there is much more at risk than just a house and what is inside of it.

The loss or damage to a house is devastating enough.

But what if there was the loss of a barn with the livestock inside that drowned?

What if the chicken coop flooded and the chickens drowned?

Then what if the flood waters wiped out the garden, berry patch, damaged the orchard and greenhouse?

And the flooding contaminated the ground water?

The loss to a homestead from a flood can be much worse than just the loss of a house and it’s contents, as devastating as that is!

If your dream is to have a homestead, it is imperative to know for sure, before purchasing it, whether or not it is in a flood plain.

How To Know If The Property Is In A Flood Plain

To know if the property is in a flood plain, you start by going to a website that has flood plain information.

There are two main websites:

- FEMA’s

- Floodtools.com

FEMA’s Website

You can go to https://msc.fema.gov/portal/search and enter the address of the property to see if it is in a flood zone.

You will get the nearest relevant flood plain map.

If you do not know the property’s address, enter the nearest property address that is known.

The map that comes up will show the risk of flooding for the properties on that map.

The flood risk is shown in zones.

Zone A and Zone V are the high risk zones.

Zone V is the most hazardous zone and includes the first row of beachfront houses.

Zone A includes areas subject to rising water such as beside or near a lake.

Flood Insurance is mandatory in these zones.

Zones B, X and C are the lowest risk areas.

Zone D includes areas that have not been studied yet where flooding may be possible.

The typical 100 year flood plain is in Zone AE.

This zone has about a 1% per year probability of flooding.

Depending on the size of the property, only a portion of it may be in a flood plain.

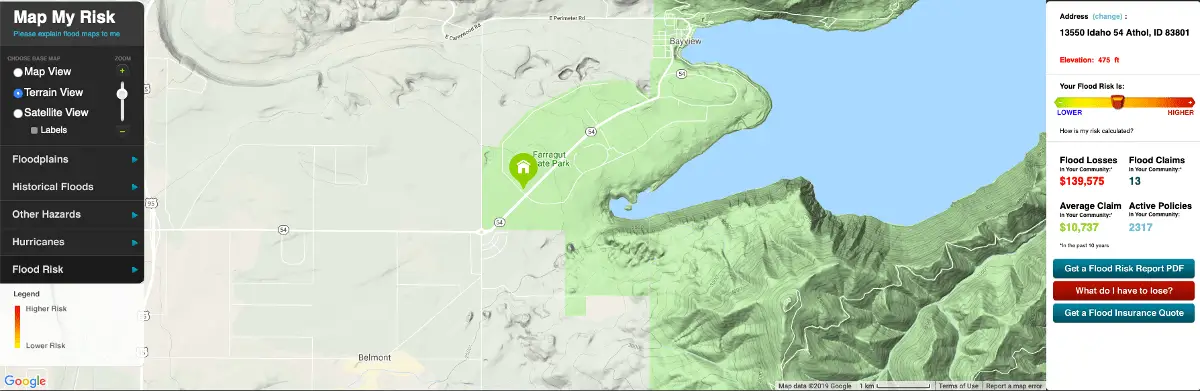

FloodTools.com

This website is more user friendly than FEMA’s.

Enter your address and a map shows up with the location of your house or property and a color guide to tell you the flood risk.

If the property is anywhere near a flood zone, there is a Get a Flood Insurance Quote button where you can get an idea of how much flood insurance would cost.

The type of Flood Zone will determine how much flood insurance will cost.

The cost can range anywhere from around $200/year all the way up to $6,000/year or more.

It is important to check and see if the property is in a Flood Zone before making an offer on the property.

When looking for Country or Homestead Property there are several problems which can create headaches for property owners.

It is best to know if any of these problems exist before you purchase the property.

Here are links to articles I have written about these problems that include:

- Being too close to power lines

- Is Radon Gas in the air and water

- Should well water be tested

- Should a homestead have a shared water source

Insuring Property In A Flood Plain

I would do an internet search for flood insurance agents near me if property you are interested in is in a flood plain.

These agents can tell you exactly how much Flood Insurance would cost.

There is also a chance that the agent would tell you that the property is not in a Flood Zone.

There are about a dozen flood zone classifications.

Each is based upon the calculated frequency of storms that could cause flooding.

In States that have Title Insurance and Title Searches, a Preliminary Title Report should tell if the property is in a flood plain.

Another place that can be checked is the County Tax Assessors Office.

The tax records of the property should tell if it is in a flood plain.

National Flood Insurance Program

The National Flood Insurance Program is a program where the U.S. government subsidizes flood insurance.

The cost of the insurance is based on several factors such as:

- The year the house was constructed

- How many people will be living there

- How many floors there are in the house

- Where things in the house are located – which floor

- The area’s flood risk

- The location of the lowest floor in relation to the Base Flood Elevation on a flood map

- The amount of your deductible

The Nationwide average premium for flood insurance is $700/year.

This means some pay less and some pay more.

The premium is based upon the property’s flood risk and those factors listed just above this paragraph.

Some people pay as much as $6,000/year for flood insurance.

Does A Seller Have To Disclose That A House Is In A Flood Zone?

Federal Law does not require Sellers or Real Estate Agents to tell potential Buyers if the house is in a flood plain.

Or if there has been any previous flooding.

The National Association of Realtors has ethical standards.

Real Estate Brokers and Agents who are members of the association, take an oath to abide by.

But not all Real Estate Brokers and Agents are members of that association.

Ethically, Sellers, Real Estate Brokers and Agents should tell prospective Buyers if the property is in a flood plain or if the property has sustained flood damage previously.

I believe that most Real Estate Brokers and Agents would disclose flood plain status and previous flooding of a property.

However, in the final analysis, it is the responsibility of the Buyer to learn the property’s history before making an offer to buy the property.

When it is your money at stake, and the amount is thousands of dollars, no one is better equipped to watch after your money than you are!

Can Flood Zones Change?

Yes!

Circumstances such as clear cut logging and large scale development in an area near a flood zone can bring about a change in flood zone status.

Both of these activities remove vegetation and lessen the land’s ability to absorb water.

This results in increased runoff and also increases the possibility of flooding in the future.

If the home you live in is included in a flood zone status change, the value of the home can drop considerably.

If your home is included in a flood zone status change and you are still paying on the mortgage, expect to receive a letter from the mortgage company demanding that you purchase flood insurance.

Keep track of potential changes in flood zone status.

If your house is near a flood zone, it is a wise idea to check for changes in the flood zone status every 5 years.

How Does Being In A Flood Zone Affect A Home’s Value?

In general, knowing that a home is in a flood zone makes it less desirable to Buyers.

Not every Buyer is willing to assume the risk of the home being damaged by a future flood.

Yes, they can purchase flood insurance, but that does not cover the loss of family heirlooms, pictures and other items important to all of us.

Having to pay flood insurance reduces the amount of monthly payments a Buyer can make.

When the amount of monthly payment is reduced, that also reduces the dollar amount that can be paid for the house.

When a house is in a flood zone its value does not appreciate as fast as it would if it was not in a flood zone.

How Wildfires Can Contribute To Flooding

When a wildfire comes through an area it removes vegetation and scars the land.

The presence of vegetation slows rainwater runoff and allows for more of the rainwater to be absorbed into the ground.

It can take several years for vegetation to regrow in an area devastated by wildfire.

Without this vegetation there is nothing to slow down the flow of rainwater and allow for it to be absorbed into the soil.

The result is the rainwater runs over the burned area and much more of it collects in creeks and rivers.

The larger the burned area, the more excess rainwater collects in the creeks and rivers.

The result is an increased chance of flooding in areas that usually do not flood.

The fire damage can be miles away from the area that floods after a rain storm.

If you live downstream from an area burned by a wildfire, do not be surprised if the spring or fall rains cause flooding.

In this case FEMA recommends being proactive and obtaining flood insurance.

Related Questions

Can I get a loan without flood insurance?

It depends on the flood zone designation the house is in.

The house is the collateral for the loan to buy it.

If a flood destroys the house, the lender has no collateral to secure the loan.

Depending on your credit history and the flood zone designation a lender might waive the requirement for flood insurance.

My house only has a 1% chance of flooding. Why is it in a flood hazard zone?

A 1% chance of a devastating flood may not seem like much of a risk.

This places your house in a 100 Year Flood Plain.

But the company you pay your mortgage payments to considers it a high risk.

No one knows for sure where they are in that 100 year cycle.

My house is in a flood zone, what can I do to minimize losses in a flood?

- If possible, raise the furnace, water heater and electric panels to help protect them from flood waters.

- Keep any storm drains and gutters free of debris.

- Consider installing check valves (one way valves) to keep flood water from backing into drains.

- If you have a basement, seal the walls with waterproof material.

- Store valuables and legal documents on upper floors if your house has them.

Related Articles

To become more educated about how to search for country or homestead property the right way you can read a very informative article I wrote on this topic, “Start Searching For Country Or Homestead Property This Way.”

Dreaming of living in the country but not sure how to accomplish that?

I wrote an article titled, “Achieve Your Country Or Homestead Dreams In 7 Easy Steps” that gives you steps you can take to live the homestead life.